So You’re Considering a Move To Dallas … What’s That Tax Situation Like? — 1943

by Paula Bosse

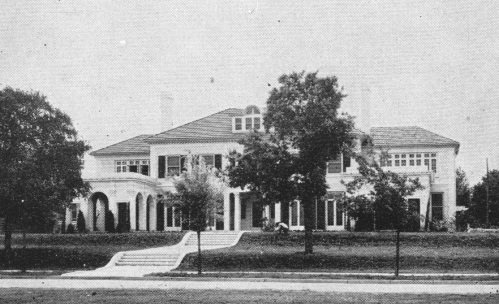

You and your gardener will *love* Dallas! (click for larger image)

You and your gardener will *love* Dallas! (click for larger image)

by Paula Bosse

It’s 1943. You’re considering relocating your business and your family to Dallas. You’ll probably be owning a mansion like the one pictured above. Should you and your large bank account settle in Dallas? I mean, is it really the best place … tax-wise?

Below is a page from a pamphlet called So This Is Dallas, a publication which was intended to sway decisions such as this. It was issued for several years by a group called “The Welcome Wagon,” and this edition came out sometime during World War II. Here’s what Big D had to offer in those days. (Click to see much larger image.)

*

Taxation…

Dallas offers a favorable tax situation that can be found in but few communities. There is no State income tax in Texas and no general sales tax.

Corporations operating in the State are subject to three forms of taxation. If they are foreign corporations, they must qualify legally in the State and pay a permit fee, an annual franchise tax and ad valorem taxes. If they are domestic corporations, they pay a fee to secure a Texas charter, an annual franchise tax and ad valoreum [sic?] taxes.

Texas laws do not discriminate against foreign corporations. The permit fee for a foreign corporation and the charter fee of a Texas corporation are arrived at in the same way, the proportionate amount of capital used in Texas by the foreign corporation and the capital stock of the domestic corporation. Franchise taxes for both foreign and domestic corporations are also assessed on the same basis.

Ad Valorem Taxes

All corporations, whether domestic or foreign, and all others owning property within the State of Texas, must render their property as of January 1 each year for city, State and county taxes. The property is rendered at its inventory value. The basis of assessment varies in different counties.

Current ad valorem taxes in Dallas are: City of Dallas, $2.45 per $100 valuation, basis of assessment 53 per cent of value; Dallas County, 74 cents per $100 valuation, basis of assessment 50 per cent of value; State, 69 cents per $100 valuation, basis of assessment 50 per cent of value.

Dallas has the lowest tax rate of any large city in the Southwest. Each city has a different basis of assessment. Reducing their rates to a basis of assessment on 100 per cent of value, net tax rates for the four leading cities in Texas are:

Dallas ….. $20.56 net per $1,000

Houston ….. $22.03 net per $1,000

San Antonio ….. $26.89 net per $1,000

Fort Worth ….. $29.25 net per $1,000

*

I don’t know what ANY of that means, but it looks like Dallas wins. Welcome to your new mansion!

***

Page from So This Is Dallas, published around 1943 by The Welcome Wagon; courtesy of the Lone Star Library Annex Facebook page.

If you recognize any of these homes, let me know and I’ll add the info here. I’m seeing what looks like Lakewood and Swiss Avenue, and maybe Highland Park and Oak Cliff.

Click pictures for larger images.

*

Copyright © 2016 Paula Bosse. All Rights Reserved.

Some might be Hutsell built homes. Some from 1920s but he also designed and built homes through the 1940s as well. Hard to know the individual histories and details without a long long search through many publications. Wish the addresses were known. Dines & Kraft built some in the Lakewood Neighborhood Association area but also other builders/developers built in other areas such as on some of the M streets to the west of Skillman.

LikeLiked by 1 person

Perhaps a Hal Thomson house as it has a very similar design to that of 5439 Swiss Ave.

LikeLiked by 1 person